If you’re in a career transition with limited financial reserves or up to your neck in alligators from overspending, run to, not from, the problem. The longer you carry this problem around, the heavier it becomes. Choose to implement all of the action items below to immediately reduce your expenses. Better yet, make it a game to see how low you can cut your expenses… you just might find that less is more.

1.Phones

Ditch your cell phone and find a long distance provider with a low per minute rate and no monthly fee.

2. Subscriptions

Cancel newspapers, magazines and other periodicals. Everything you need is free in the library, accessible via the Internet or on television.

3.Utilities

Turn down your thermostat, use energy-saving light fixtures, turn off lights when you leave a room, ask your local utility companies about budget billing, and check out the many other energy and money saving tips listed at the US Department of Energy website

4. Taxes

If you are employed, ask if your employer offers a Section 125 Plan or Flexible Spending Program. If so, enroll in the plan as soon as possible to pay your health premium, health expenses and dependent care expenses (if applicable) with pre-tax dollars.

5. Doctor

Buy generic prescriptions when possible and get the best price by calling and comparing prices at local pharmacies, increase your health coverage deductible, and read and understand your health plan to be a smart health care consumer and save dollars.

6. Things in your house

Clean, organize and simplify your home environment. Host a garage sale and fill it with the things you don’t use, don’t have space to display, or can’t easily access. You might also consider selling items on eBay. Another option is to donate your items to charity, as your gift may be deductible. Your things are someone else’s treasure.

7. Meals

If you’re working, grab your lunch, shop at a discount grocery store and buy in bulk, cut out junk food, avoid buying pre-packaged meals, and avoid dining out. Have you ever stopped to think that your daily latte can cost you $600 per year?

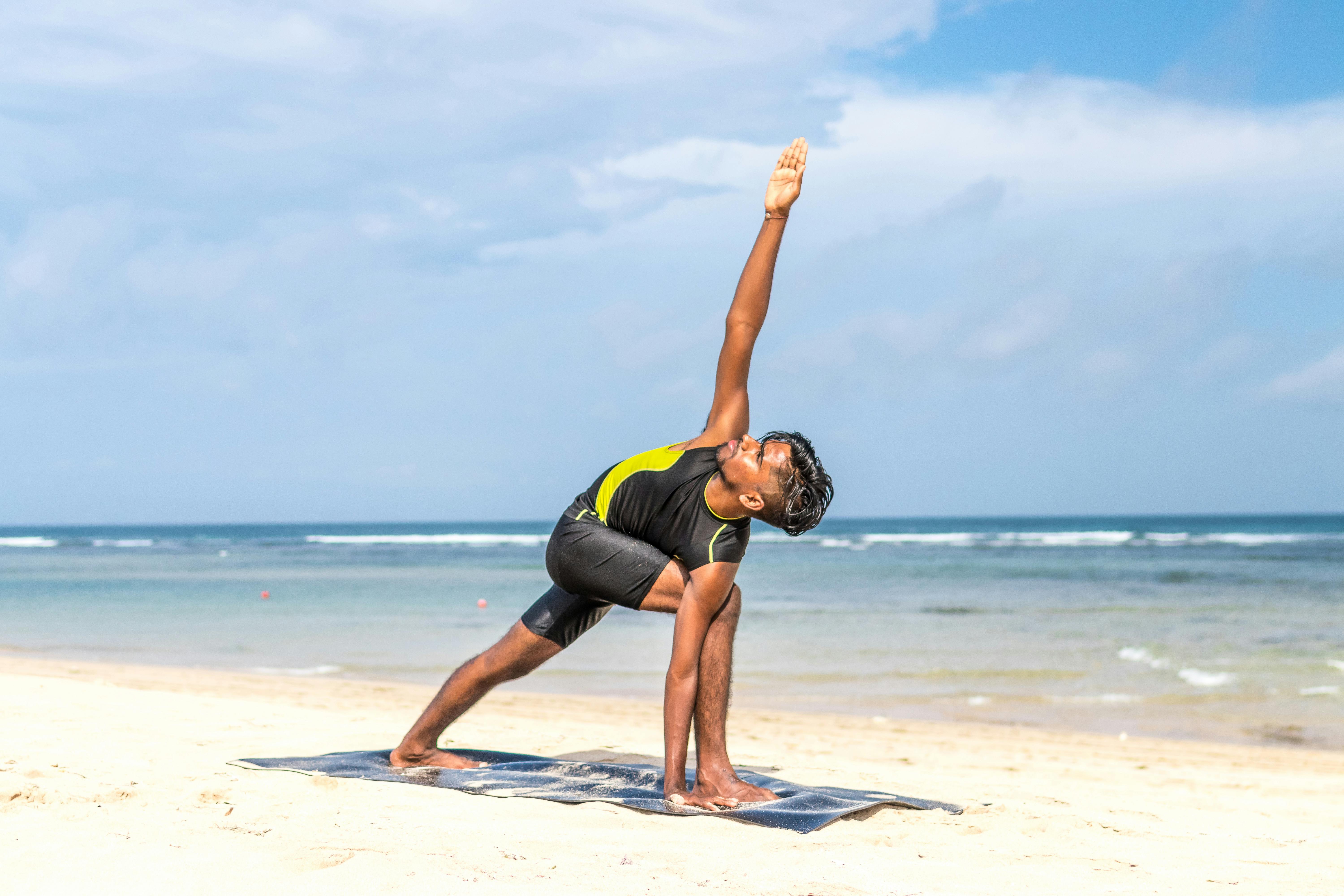

8.Fitness

Cancel your gym membership. Try walking, running, hiking, or biking. It’s easier and more convenient to walk out your front door and start exercising, plus the fresh air is invigorating.

9. Recreation and fun

Stay home with a good book or rent a video or DVD instead of going to the movies. Make your own popcorn, curl up in your favorite chair, and have a fun night at home. As painful as it is, you could also drop your cable TV.

10. Lifestyle

Money problems are rarely about money, but stem from your lifestyle choices. For example, I recently spoke with a small business owner who told me that he was having financial problems and was looking for ideas to save his business. He then mentioned that he was taking his family on vacation next month. He must have felt it necessary to justify his vacation plans because he proceeded to tell me that he was going to take the vacation despite his dire financial situation, as it was important to create a positive memory and a good time for the sons of him I wonder how much he’ll enjoy the holidays when his business is about to collapse.

If you have financial problems or see what is looming on the horizon, do not try to justify spending more money, reduce all expenses today and when you are debt free start saving and building at least a year of financial resources. Reserve. Can be done! Good luck.

Recent Comments